FEE WAIVERS OR SUBSIDIES

Fee Waiver Program (Specific Program)

The Fee Waiver Program is a specific program that was repealed by Ord. No. 182237, Eff. 9/28/12.

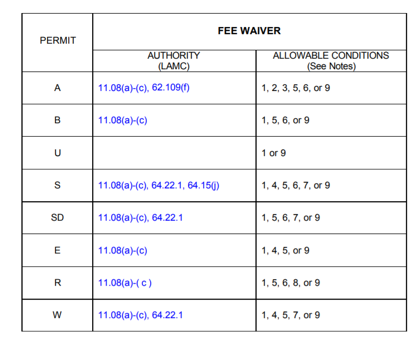

Fees for permits issued by the Bureau of Engineering MAY be waived ONLY under the following conditions. Applicants will be required to submit their request in writing to the District Engineer stating what sections they believe qualifies them for a waiver.

- Adopted Council Motions

- Damage caused by subsidence, pavement failure, deterioration, earthquake, and trees located in the public way per LAMC 61.09(e). Applicants must provide a photograph as supporting evidence.

- Repair or reconstruct sidewalk adjoining the property owner's property (Amended by Ord. No. 184179, Eff. 5/5/16.)

- Per LAMC 11.08(a)-(c), City departments, bureaus, and offices performing any official service are exempt from permit fees provided that a written certification signed by the administrative head of the department, bureau or office is submitted stating that the permit fees will not be reimbursed from any of the following funds: Revolving, Trust, Bond or Capital Improvement Project. Proprietary departments that control their own funds such as Airports, Water and Power, and Harbor are not exempt.

- Per LAMC 11.08(a)-(c), City departments, bureaus, and offices are exempt from permit fees if work being performed is in connection with the relocation or restoration of buildings or structures determined pursuant to Article 5 of Chapter 7 of Division 22 of the Los Angeles Administrative Code to be historical or cultural monuments provided that a written certification by the Cultural Heritage Board is submitted stating that such building or structure is a cultural or historical monument and that it is being relocated to or improved upon a site or facility approved by the City Council for the purposes of preserving, maintaining and exhibiting such monuments. Proprietary departments that control their own funds such as Airports, Water and Power, and Harbor are not exempt.

- Permits issued to other governmental agencies may have the fees waived upon approval of the City Engineer. (i.e. Los Angeles County Sanitation Districts, City of Gardena-Council File No. 13-0745). The proper method for fees to be waived for adjacent cities and the County is with a Master Agreement. As of September 2014, the writing of this procedure had no Master Agreement is in place with the County of Los Angeles.

- Caltrans - Per California Government Code, Section 6103.6 and 6103.07, Caltrans is exempt from paying fees for permit issuance, inspection services, or plan checking to a local agency for work done in, under, on, or about any local agency roadway.

- The California State University (CSU), the University of California (UC), and the California Community College systems are NOT exempt from paying permit fees.

- Non-Profit Organization (501 (c) (3)) Development Fee Subsidy - Per LA Administrative Code Division 5, Chapter 4, Article 3, the following is a summary of the Fee Subsidy Policy.

- Must be approved by the City Council

- Only be provided for projects undertaken by non-profit organizations when those projects promote a public purpose and provide a minimum level of public benefit

- Must show proof of non-profit status through a letter of determination by the IRS that the organization is exempt from federal income taxes under the Internal Revenue Code as an organization described in Section 501 (c)(3) or other similar provision of the Internal Revenue Code.

- Subsidies may also be provided for public physical plant type construction projects including:

- street resurfacing

- sewers

- storm drains

- sidewalks

- sidewalk repairs

- curbs and gutters

- The above applies if undertaken by individuals, non-profit organizations or for-profit organizations at their own expense, in the public right-of-way, and for which no profit will be realized. Council must adopt findings, supported by specific facts, that a public physical plant type construction project for which a Development Fee subsidy is provided will promote a public purpose for the City and provide a public benefit.

- Subsidies shall be limited to 50 percent of the total eligible fees and may not exceed a total of $50,000. Further, subsidies shall be limited to one project annually, on a fiscal year basis, for any qualifying organization, including subsidiaries, affiliated or related entities.

- For joint-use projects, subsidies shall be prorated for the public purpose portion of the construction project based on square footage or the percentage of the organization's financial participation in the project, whichever is greater. A joint use project is a project to construct a structure in which a public purpose use (e.g. health care center, childcare center, senior citizens service center, after school programs) is operating in the structure alongside a profit-making venture (e.g. leased office space, storage, mini-market, restaurant).

- Subsidies will not be given for fees imposed by the State or other government agencies including, but not limited to, fees set by the State Department of Health Services, State Department of Industrial Relations (Occupational Safety and Health Administration), South Coast Air Quality Management District, and the Los Angeles Unified School District. In addition, Quimby fees and Arts Development fees shall not qualify for subsidies.

- The organization receiving the subsidy must provide written assurances to the City's satisfaction that the facility will be used for the stated public purpose for the expected useful life of the facility or improvement. If the use of the facility or improvement changes so that it becomes a private or religious use, then the organization must reimburse the City for the fee subsidy, on a pro-rata basis, from the date of the change in use to the end of the useful life of the building, plus applicable interest at the legal rate specified in California Civil Code Section 1916-1 or any successor provision, as amended from time to time.

- Organizations receiving the benefit of the Development Fee subsidy for projects that are not public physical plant type projects in the public right-of-way, must certify annually to the Chief Legislative Analyst (under penalty of perjury) for the life of the facility or improvement, that the public benefit required continues to be, and will continue to be provided for the time specified. If at any time the required annual certification is not provided when due and, after reasonable notice to cure that default is not provided, the organization must reimburse the City for the fee subsidy, on a pro-rata basis, from the date of the delinquency to the end of the useful life of the construction project, plus applicable interest at the legal rate specified in California Civil Code Section 1916-1 or any successor provision, as amended from time to time.

- Subsidies shall not be granted to religious organizations other than for fees that apply to construction of facilities or improvements that will be utilized exclusively for secular purposes and that meet all of the requirements of this Article.

- Requests for subsidies shall be referred to the City Administrative Officer (CAO) for review and recommendation prior to consideration by the City Council. The CAO shall review the request for compliance with this Article and include a determination of the ability of the organization to fund the total cost of the project. Subsidies from non-profit organizations with an operating budget of less than $5.0 million will qualify for consideration by the City Council if all applicable requirements of this Article are met. A non-profit organization may be disqualified depending on the organization's operating budget and capital budgets, or its refusal to provide sufficient financial information to the CAO to make a determination of its financial capability.

- Subsidy requests must be made in writing setting forth all relevant information and demonstrating and documenting compliance with the requirements set forth in this Article. In order to be considered by the City Council, a subsidy request must be presented by written motion by a Member of the Council.

- Each action by the City Council to approve a subsidy request must include a transfer of funds in the amount approved from the General City Purposes Fund NO.1 00/56, Special Fund Fee Subsidy Account, or other available source of funds, to the appropriate department fund and account.

- The Chief Legislative Analyst shall track the number and amount of subsidies approved by the Council and forward that information to the CAO for inclusion in financial status reports.

- The Chief Legislative Analyst shall monitor subsidy recipients for annual certification of provision of the public benefit required and to report to the Council periodically, as necessary, when organizations do not comply with the public benefit requirements.

- The CAO and the Chief Legislative Analyst shall review the Subsidy Policy set forth in this Article annually, in conjunction with the annual budget deliberations, and report to the City Council on the fiscal impact on the General Fund.

- Development Fees shall not be waived except as expressly authorized by applicable law. Subsidies of Development Fees shall be provided only in accordance with this Article.

Comments