Procedure to Process a Claim for Refund (CFR)

The following procedure instructs City staff on how to process a Claim for Refund (CFR) on the BOE CFR online application. Currently there are two distinct processes for refunds, one for Sewer Fees (LAMC 61.19) and other Refunds for "Tax, License, and Permit Fees" (LAMC 22.12 and LAMC 22.13).

Per 22.13(a), the head of a department or office (Bureau Head) may approve refunds of tax, license fee, permit fee, or application fee if the refund does not exceed the amount determined by the City Controller. This amount is adjusted annually via an annual Memorandum (update issued in August each year, City staff can also acces the document by going to https://controller.insidela.org/memos/overview and select the current year) from the City Controller. In addition, per LAMC 22.13(d), the head of any department or office, authorizing any refund of taxes or fees hereunder, shall at a minimum submit on an annual basis, to Council and the Controller, a detailed report showing:

- Names and addresses of the persons receiving such refunds

- Amounts thereof

- Kinds of taxes or fees refunded

- Reasons why said refunds were made

Per LAMC 22.12, if the amount exceeds the amount determined by the City Controller, the application would need to file a Claim for Refund with the City Clerk within 12 months after the date of payment. Applicants must apply for the Claim for Refund (name must be the same as on the permit) prior to BOE processing the request.

Applicants shall provide all documents supporting the refund request including:

- A copy of the permit

- A signed copy of the printed claim

- Any receipts that shows the payment(s) made

- Any other applicable documents

Applicants can email, upload, fax, or hand carry the supporting documents after they submit the refund claim online. The customer must write the claim reference number on the top portion of each supporting document, so City Staff can relate those documents to the claim. Applicants who provide a valid email address will be notified of any missing information in their applications and/or when the claim is fully processed.

If the claim is being filed for Sewer Fees (LAMC 61.19), the claim shall always be filed with the City Clerk with BOE providing verification of the claim.

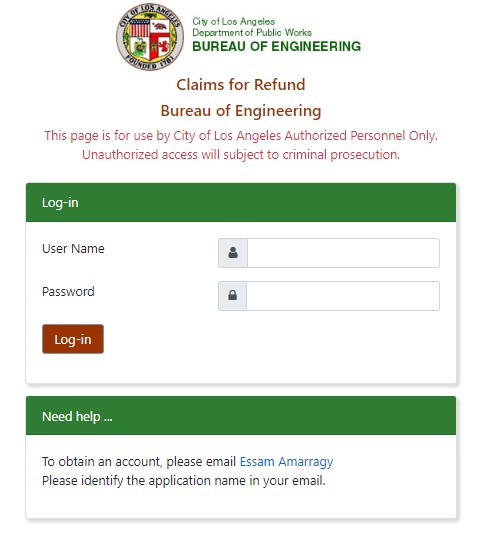

BOE CFR Online Application

Select the BOE Claims for Refund Application and login.

- Select “View Unprocessed Claims” to see a list of Claims that are pending or new.

- Select the reference number of the claim you wish to review.

- Verify the information on the claim and review the attached documents.

- Name of Claimant must match the name used on the permit. If the name of Claimant does not match the name used on the permit, then a notarized "Assignment of Rights" statement will be needed from the person who applied for the permit

- A detailed explanation for the refund must be included

- Proof of payment must be attached

- Once the information from the Claimant has been obtained, the District Office staff shall:

- Input the approved amount to be refunded minus any appropriate fees or surcharges that are to be withheld. If the amount exceeds that of the District Engineer's authority a Board Report shall also be prepared requesting the Board forward the recommendation to City Council for a decision.

- Select appropriate section of the code that allows the refund and/or enter in a reason for approval.

- Include a system generated report showing the revenue distribution.

- If the payment was completed utilizing Universal Cashiering, provide a screenshot of the transaction.

- If the payment was completed prior to Universal Cashiering, attach a copy of the receipt with quick codes or video journal.

- Lock Application and select “Forward to District Engineer” to finalize the Claim

- If the amount exceeds the authority of the District Engineer, the following steps shall apply:

- BOE staff shall prepare a Board Report (sample Board Report for this case) which will contain the following information, per the Board Report Procedures Manual:

- Recommendations

- Transmittals

- Fiscal Impact

- Discussion

- Status of Funding

- Mark the original copy as refunded. Note the Claim Reference number.

- If City Council rendered the decision about the claim, BOE would mark the claim as "Denied" in the Claim for Refund application and include a note about the City Council decision in the Notes section of the Claim for Refund application.

- BOE staff shall prepare a Board Report (sample Board Report for this case) which will contain the following information, per the Board Report Procedures Manual:

- If the amount exceeds the authority of the District Engineer, the following steps shall apply:

- Geocode the Claim

- If permit or certificate is to be canceled, change the status in the application and remove the geo-code associated with the permit or certificate.

- Select geo-code link in the appropriate permit application, select Location Number and double click on the geo-coded permit/certificate. A pop-up screen will appear giving you the option to delete the geo-code. Select Delete to remove the geo-code.

- Select “View Final Claim” if you wish to make a print of the Claim.

- “Status Report of Unprocessed Claim” lists all the Claims that have not been through the final process.

- Use the reference number and “Search for a Claim” to view the status or where it is in the queue.

- Claim Count Summary will list the number of claims processed and how much in total has been refunded based on a given date range.

- Select “Search for a Claim” if you know the reference number and you are asked for the status of that claim.

- Select “New Claim” to input the Claimant’s information and reason for submitting for a claim. Fill in the required boxes, the date paid, and a reason for the Claim.

- Follow the steps above for Reviewing the Claim.

- Items that were paid for at the Land Development Group (LGD) should be forwarded to Land Development by District staff.

- Select the “Forward to LGD” box to send the refund request to their queue.

ADDITIONAL CLAIM FOR REFUND INFORMATION FROM THE CITY OF LOS ANGELES MUNICIPAL CODE

LAMC 22.12(b) - This section is remedial in purpose; its terms and requirements shall not be deemed to limit or qualify the lawful right of any person to bring or maintain any action or proceeding based upon the general law of this state for any remedy provided by that law. (Added by Ord. No. 79,588, Eff. 5/21/38 – No Hyperlink Available)

LAMC 22.12(c) - The monetary limitations in Subsection (a) above shall be subject to an adjustment at the beginning of each fiscal year after 1995-96 based upon the Consumer Price Index for all urban consumers for the Los Angeles area published by the United States Department of Labor, Bureau of Labor Statistics. The Controller shall calculate the adjustment in accordance with the methodology used to calculate monetary limits for intra departmental fund transfers pursuant to Los Angeles City Charter Section 343(c) and shall notify department heads in writing of the adjusted monetary limit. (Amended by Ord. No. 173,304, Eff. 6/30/00, Oper. 7/1/00.)

LAMC 22.13(a) - The head of any department or office in which there is collected or received for and on behalf of the City any tax administered by the City, license fee, permit fee or application fee may, upon written application of the person who paid such tax or fee, filed with such department or office, refund all or part of such payment as herein provided, and not otherwise, without the necessity of first receiving the approval of the City Council therefor, if such refund does not exceed the sum of $63,476, and if the head of such department or office is satisfied, upon such proof as may be presented to or required by him or her, that any of the following conditions exist: (First Sentence Amended by Ord. No. 174,174, Eff. 9/21/01.)

- Where a refund is specifically authorized by the provision of law requiring payment of the tax, license, permit or application fee.

- Where the money is paid to secure a business tax registration certificate, license or permit not required by law.

- Where the amount paid was in excess of the amount required by law.

- Where the money paid was not required by law.

- Where the applicant for any business tax registration certificate, license or permit has not, at any time after the commencement of the period or term during which the requested certificate, license or permit would have been effective, commenced or engaged in the business or occupation, or performed any act, for which the certificate, license or permit was required; or where a person has filed an application or appeal and subsequently has withdrawn said application or appeal; provided, however, that the City has not made any physical inspection or examination of real property, held or conducted any hearing, performed any tests, or done any similar work, whether required or contemplated by law or not, as a result of the filing or issuance of any of the foregoing; and, provided further, that the certificate, license, or permit, if the same has in fact been issued, must be surrendered for cancellation and a written request for such cancellation must be filed with the department of the City issuing the same on or before the date of refund. In case of refunds made under this condition, 20 percent of the amount paid shall be deducted and retained by the City to cover clerical and other overhead costs and expenses entailed in the transaction.

LAMC 22.13(b) - The provisions of this section shall not relieve any person from compliance with the provisions of City Charter Section 350 relating to the presentation of claims prior to the bringing of a suit or action thereon, or be deemed to limit or qualify the lawful right of any person to bring or maintain any action or proceeding based upon the general law of this state for any remedy provided by that law. (Amended by Ord. No. 173,304, Eff. 6/30/00, Oper. 7/1/00.)

LAMC 22.13(c) - The head of any department or office making any refund of taxes or fees hereunder is hereby authorized to cause a demand to be drawn on the general fund or such other fund in which such tax, license, permit or application fee may have been deposited. (Amended by Ord. No. 174,174, Eff. 9/21/01.)

LAMC 22.13(d) - The head of any department or office, authorizing any refund of taxes or fees hereunder, shall cause a detailed report thereof to be made, showing the names and addresses of the persons receiving such refunds, the amounts thereof, the kinds of taxes or fees refunded, and the reasons why said refunds were made. Such report shall be transmitted to the Council and the Controller at such times as the Council may require, but not less frequently than annually. (Amended by Ord. No. 174,174, Eff. 9/21/01.)

LAMC 22.13(e) - The monetary limitations in Subsection (a) above shall be subject to an adjustment at the beginning of each fiscal year after 1995-96 based upon the Consumer Price Index for all urban consumers for the Los Angeles area published by the United States Department of Labor, Bureau of Labor Statistics. The Controller shall calculate the adjustment in accordance with the methodology used to calculate monetary limits for intra departmental fund transfers pursuant to Los Angeles City Charter Section 343(c) and shall notify department heads in writing of the adjusted monetary limit. (Amended by Ord. No. 173,304, Eff. 6/30/00, Oper. 7/1/00.)

LAMC 64.19(a) - Any money collected or received by the City in accordance with Section 64.11.2, 64.16.1 or 64.18 may be refunded as provided in this Subsection, or may be credited pursuant to the provisions of Subsection (b) or (e) of this Section, and not otherwise, if a verified claim in writing is filed with the City Clerk accompanied by the original receipt or certificate for the fees collected. If said receipt or certificate cannot be located, an affidavit must be filed with the claim which satisfactorily explains why it cannot be located. Such refund shall be made only on the following conditions: (First Sentence Amended by Ord. No. 182,076, Eff. 4/6/12.)

- Where payment was made per Section 64.11.2 and tract proceedings have expired or been abandoned, the claim must be filed within one year from the date said proceedings expired or where abandoned.

- Where payment was made per Section 64.11.2 and a refund is due because the amount paid was more than that required for the developed property pursuant to Section 64.11.3, the claim must be filed after and within one year from the date the property was fully developed.

- Where payment was made per Section 64.16.1 or 64.18 and a house connection permit to connect improvements to the public sewer was obtained per Section 64.12 and where the house connection permit expired or was cancelled and said payment is no longer required, the claim must be filed within one year from the date said permit expired or was cancelled.

- Where payment was made per Section 64.16.1 or 64.18 and no house connection permit to connect improvements to the public sewer was obtained, and said payment is not required, the claim must be filed within one year after expiration of the building permit, as such expiration is determined by Section 98.0602 of this Code. (Amended by Ord. No. 168, 533, Eff. 3/1/93.)

- Where payment was made per Section 64.16.l or 64.18 and no house connection permit to connect improvements to the public sewer was obtained, the time for a plan check, including any extension, pursuant to Section 98.0603 of this Code, has expired, and no payment is required the claim must be filed within one year after the date of such expiration. (Added by Ord. No. 168, 533, Eff. 3/1/93.)

- (Amended by Ord. No. 171,036, Eff. 6/6/96.) Where payment was made per Section 64.16.1 for a new building and later a demolition occurs on the same lot or parcel, a refund shall be allowed for the demolished building subject to the following:

- The demolition must occur within two years of the payment of the Sewerage Facilities Charge for the new building.

- The written application for refund must be made within one year of said demolition and must be accompanied by proof of demolition satisfactory to the City Engineer.

- The amount of the refund shall be the amount of monetary credit calculated per Section 64.16.1, Subsection (c), applicable to the demolished building at the time of sign-off of the Demolition Certificate but shall not exceed the amount of the charge which has been paid for the new building on the same lot or parcel.

- (Former Subdiv. 6 Renumbered by Ord. No 168,533, Eff. 3/1/93.) Where payment was made per Section 64.18 and thereafter a public sewer is constructed to serve such property and the property is assessed for the construction thereof, the claim must be filed within one year from the date notice is mailed to the last address of the owner of the land that the City Council has confirmed the final assessments for said sewer.

- (Former Subdiv. 7 Renumbered by Ord. No 168,533, Eff. 3/1/93.) Where payment was made per any of the above sections and such amount was collected wholly or partially in error, or was in excess of that required by said sections, the claim must be filed within one year from the date the error was discovered or should have been discovered by any owner of the property for which payment was made.

- (Former Subdiv. 8 Renumbered by Ord. No 168,533, Eff. 3/1/93.) Where payment has been made pursuant to Section 64.11.2 or Section 64.16.1 subsequent to December 15, 1981, and sewage from the subject property is or will be treated in the facilities of a Los Angeles County Sanitation District, the permittee or person making such payment may apply for a refund of 85% of the fee specified in Section 64.11.2 or the applicable charge specified in Section 64.11.3. The claims must be filed within one year from the date the payment is made or within one year from the effective date of the ordinance adding Subdivision 8 to Subsection (a) of this section, whichever period is longer. (Added by Ord. No. 157,145, Eff. 11/22/82.)

- Where payment was made between May 8, 1988 and June 21, 1991, per Section 64.16.1 or Section 64.18, and the project was subsequently canceled, the claim must be filed within one year of the effective date of this ordinance. (Added by Ord. No. 168,946, Eff. 9/2/93.) No refund shall be made of money collected pursuant to Section 64.18 hereof, which must be paid to a school district or a department of this City, other than the Department of Public Works, in accordance with any ordinance of this City.

LAMC 64.19(b) - The right to any refund under this Section is payable to the permittee. After the time provided in this Section to apply for a refund expires, the right to a credit for a refund runs with the land, except for credits that are issued pursuant to the provisions of Subsection (e) of this Section. (Amended by Ord. No. 182,076, Eff. 4/6/12.)

LAMC 64,19(c) Where a refund is due under the provisions of Subsection (a) of this Section or a refund credit is due pursuant to the provisions of Subsection (e) of this Section and the refund or refund credit does not exceed the sum of $25,000, the Board is authorized to make such refund or refund credit without the necessity of first receiving the approval of the City Council, and is authorized to cause a demand to be drawn on the general fund or any other fund in which the fees being refunded may have been deposited. (Amended by Ord. No. 182,076, Eff. 4/6/12.)

Comments